If you believe your house is unfairly over-assessed, the Ector County Tax Assessor can provide you with a tax appeal form and inform you of the tax appeal process. Call the Assessor's Office and ask for details.

Additional exemptions might be available for farmland, green space, veterans, or others. The Ector County Tax Assessor can provide you with an application form for the Ector County homestead exemption, which can provide a modest property tax break for properties which are used as the primary residence of their owners. Payments may be made to the county tax collector or treasurer instead of the assessor. The Ector County Tax Assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay your property taxes, or arrange a payment plan. The Assessor may also re-appraise a property in the event of significant damage Unreported renovations will generally be discovered by the Assessor during the next on-site appraisal of the property. Renovations may be reported to the Assessor's Office by the zoning board, contractors, or by the homeowner themselves. The Hays County Tax Office also collects property taxes for all other taxing jurisdictions (school districts, cities and special districts). Use of this information is at your own risk. Tax records can be mistaken and are not accurate for purposes other than taxation. The Tax Assessor-Collector is the constitutional office directed to assess and collect all ad valorem tax accounts as identified and valued by the Hays Central Appraisal District (CAD). The Lewis County parcel search displays data from Lewis County tax records.

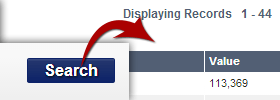

If you renovate your property (such as by adding living space, bedrooms, or bathrooms), the Ector County Assessor will re-appraise your home to reflect the value of your new additions. Click 'Advanced' for more search options. Jenifer O’Kane, PCC Hays County Tax Assessor-Collector. The assessor's office can provide you with a copy of your property's most recent appraisal on request. The Ector County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis, based on the features of the property and the fair market value of comparable properties in the same neighbourhood. The Ector County assessor's office can help you with many of your property tax related issues, including: city, school, county, water district in this case, a school district.The Ector County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Ector County, and may establish the amount of tax due on that property based on the fair market value appraisal. For example: 001-902-02 Cayuga Independent School DistrictĠ01 - Refers to the county in which the taxing unit is located in this case, Anderson County (001).ĩ02 - Refers to the taxing unit's unique identifying number also called "unit identifier".Ġ2 - Refers to the type of taxing unit, i.e. Select your county below:Įach taxing unit has a unique numerical code, consisting of eight numbers. Voluntary Liens titles, deeds, mortgages, releases, assignments, foreclosure records. Title History ownership title history, deeds and mortgage records.

The property’s taxable value is 33.33 of its appraised value minus applicable exemptions. The Assessor’s Office, through statistical and analytical methods, determines the appraised value of the property. This directory is periodically updated with information as reported by appraisal districts and tax offices. Ector County Property Records provided by HomeInfoMax: Property Reports ownership information, property details, tax records, legal descriptions. The Assessor is required by New Mexico law to discover, list and value all property within the county. Taxing units are identified by a numerical coding system that includes taxing unit classification codes. Learn about appraiser certification and education requirements. Browse information on what actually counts as personal property for assessment purposes. Find answers to frequently asked questions about property tax abatement. This directory contains contact information for appraisal districts and county tax offices and includes a listing of the taxing units each serves. View a sample assessment notice as well as terms and explanations related to it. Questions about a taxing unit that is not listed as consolidated in a county should be directed to the individual taxing unit.

0 kommentar(er)

0 kommentar(er)